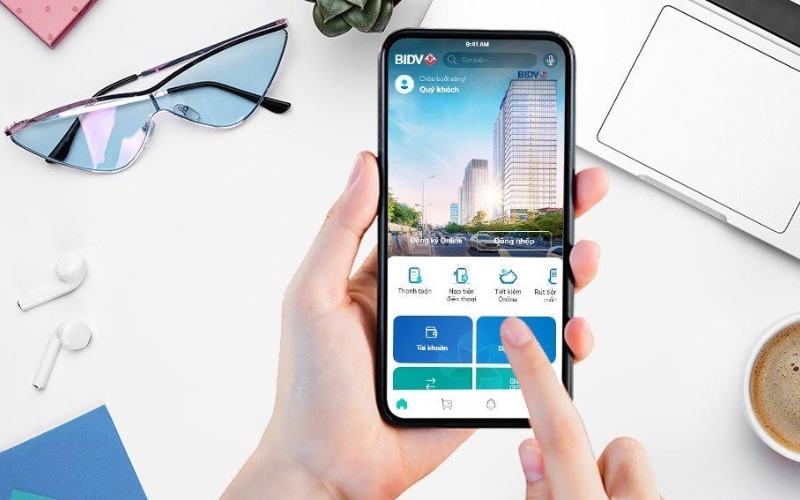

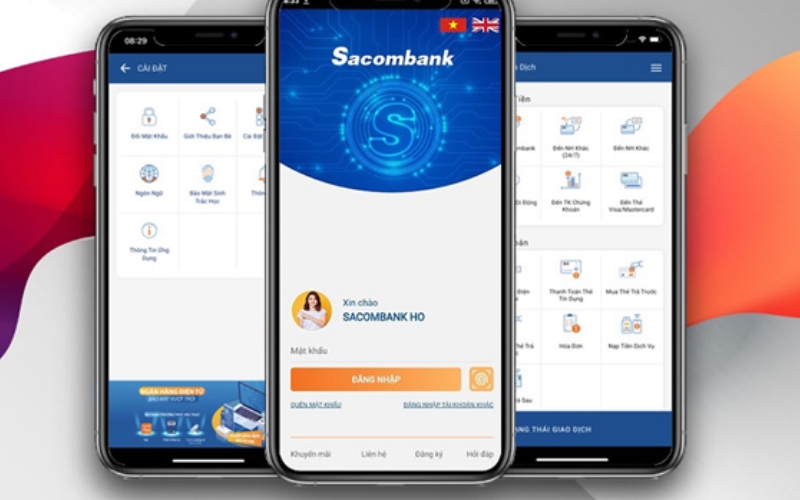

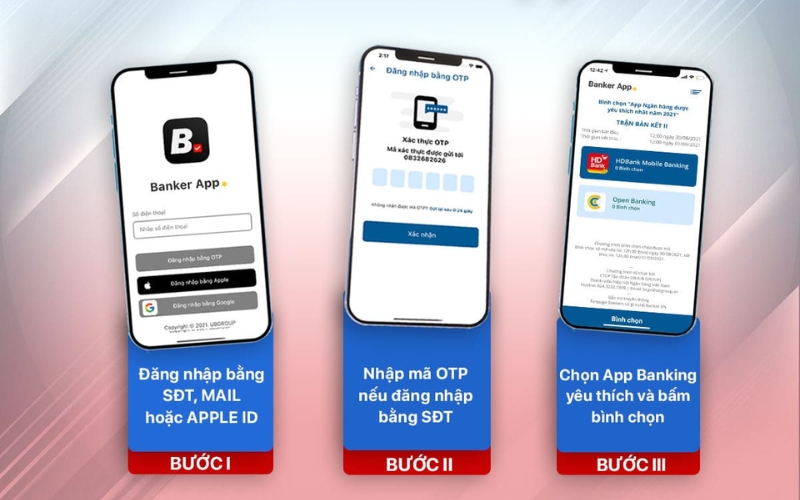

Why Banks Are Shifting to Mobile

Why Banks Are Shifting to Mobile significant transformation over the past two decades, driven by advancements in technology and changing consumer behavior. One of the most notable shifts has been the increasing reliance on mobile technology, with banks around the world adopting mobile-first strategies to meet the demands of their customers. The rise of mobile … Read more